MONARC

A next generation savings account for the modern millennial

Advisors: Hasan Kazmi (CitiVentures), Roger Mader (Ampersand), Criswell Lappin (Scrollmotion)

Team: Jennifer Wei, Jason Branch

Roles: research, interviews, synthesis, led prototype ideation/concept, user personas, UX/UI, video

Categories: UX research/strategy, product design, UX / UI, video, prototyping

"I really like this solution. At Citi, we have been trying to figure out how to change people's behaviors but the MONARC team figured out a great solution that works with existing behaviors to help people save money."

Hasan Kazmi (Head of Strategy & Partnerships at Citi Ventures Global Innovation Network)

"Any ideas need to be easy. People are not clamoring for a lot of features. There should be no obstacles to your daily habits or very few. It should be easy and simple and fast. Get the message out simply and clearly. The clearer, less complicated the idea, the more scale you’ll have."

-Sandra Reilly (Citibank)

PROBLEM

There are over 80 million millennials in the United States, the largest demographic in American history.

A majority are not saving effectively for emergencies and delaying important life milestones such as marriage and purchasing a home. Many try to save diligently but with no true purpose or goals in mind.

CHALLENGE

How might we challenge how a traditional banking institution engages with millennials in a way that makes saving an inherent part of their daily routine?

SOLUTION

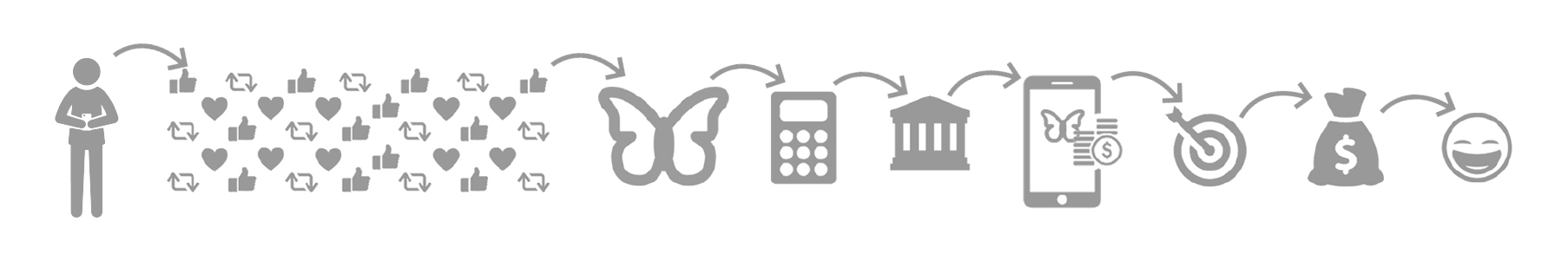

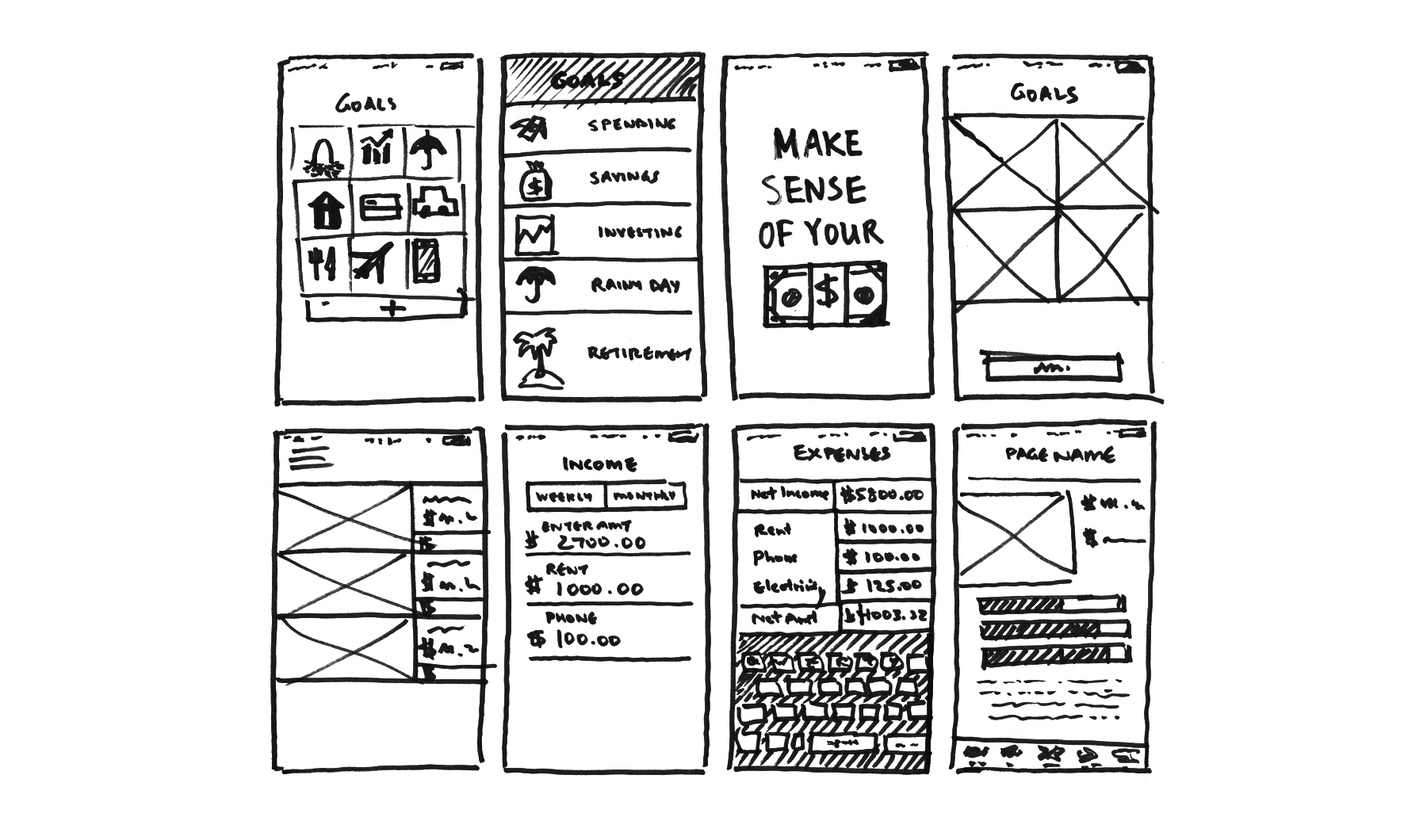

Amongst the endless sea of fin-tech apps that exist, MONARC stands out in its simplicity. A banking app that taps into ingrained existing behavior in order to effectively save money in a fun and painless way. The ingrained behavior is social media, something that millennials engage in on a constant basis.

MONARC connects with your social media apps and garners the number of likes you get on content that you have posted on apps such as Instagram, Facebook, Twitter, etc. It then helps you transfer your own hard-earned money into the MONARC savings app based on those daily likes.

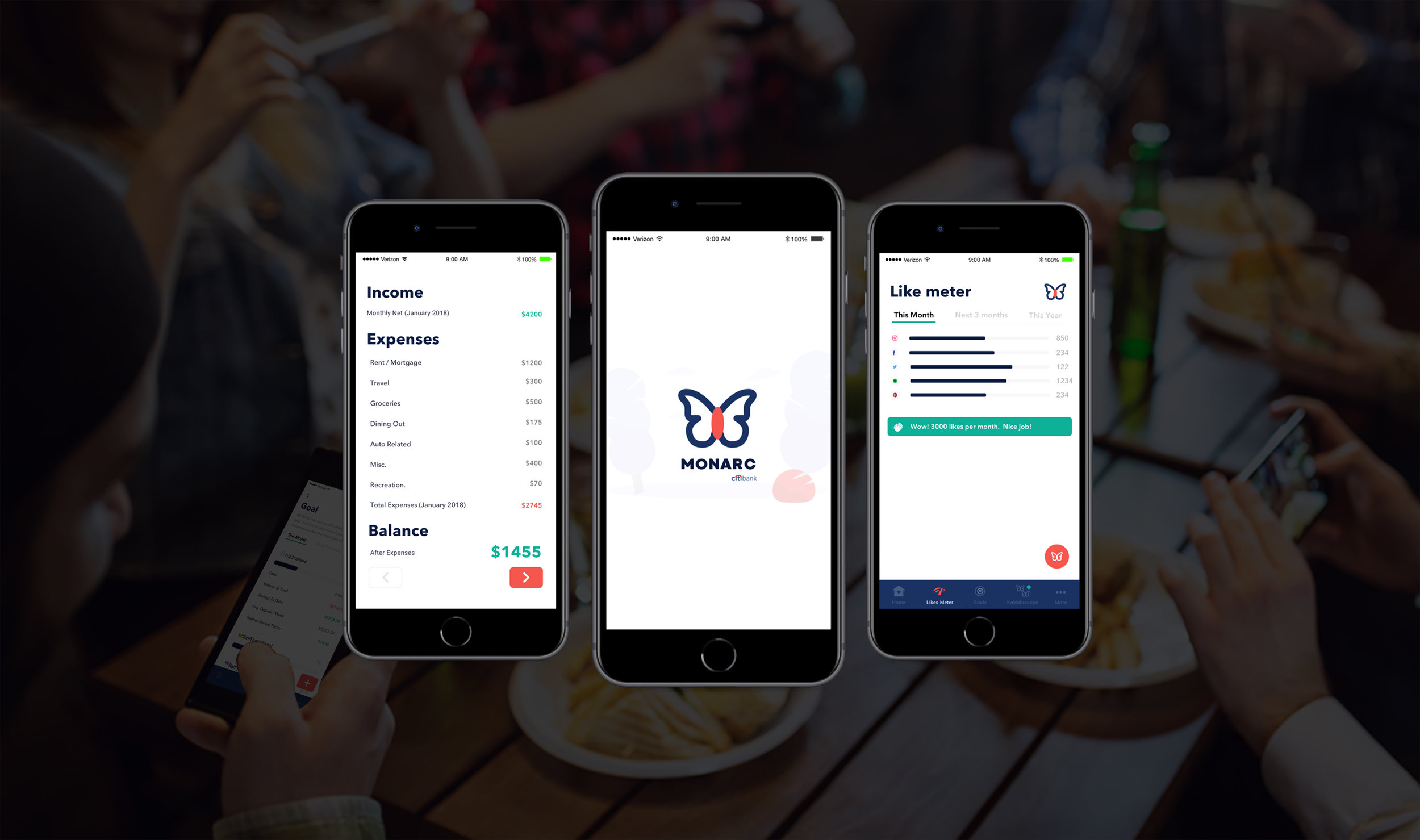

SCREENS

SPLASH + ACCOUNT SETUP

INPUTTING FINANCIAL INFO

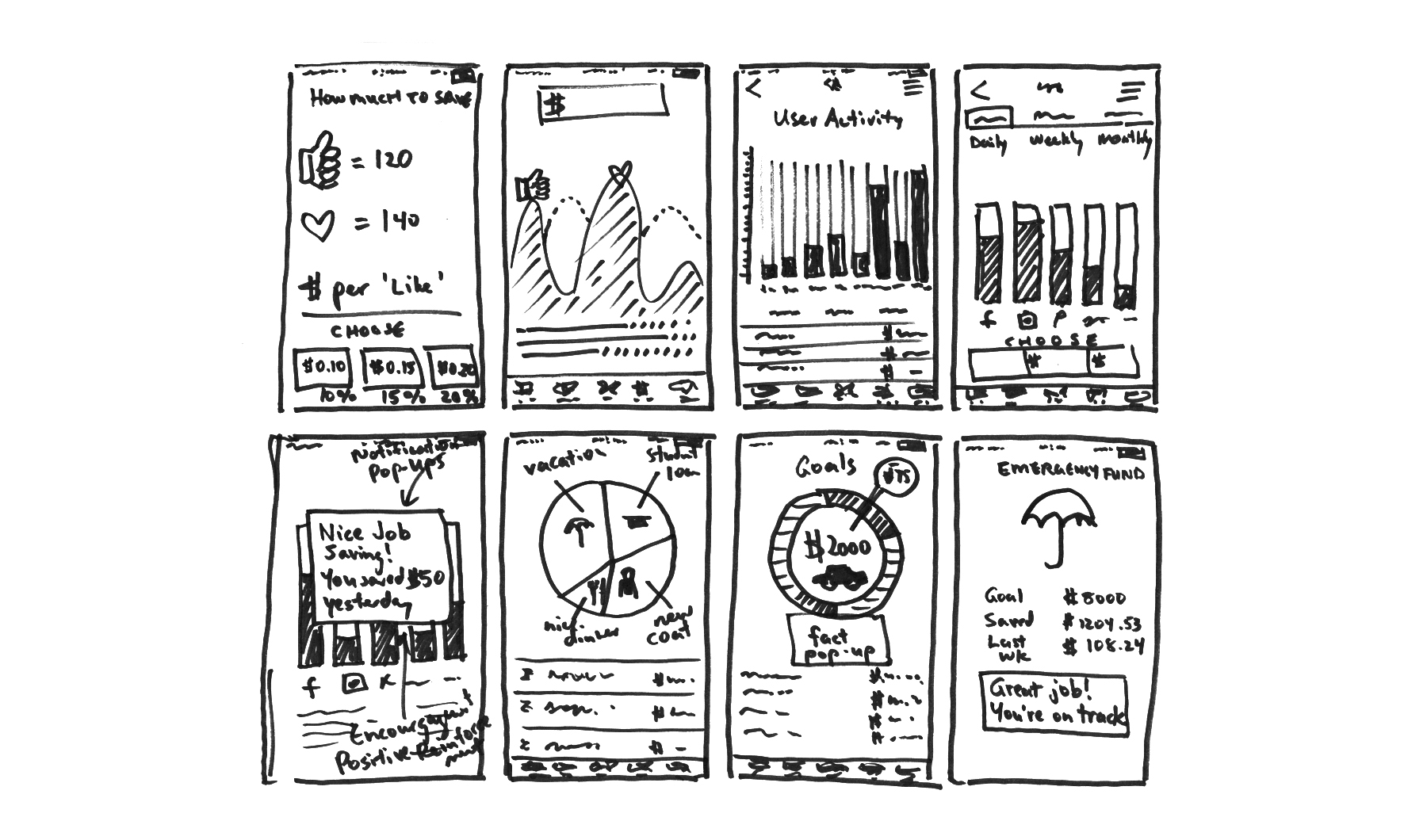

MONARC will help you calculate how much you can save, based on your savings, spending and social media habits. Using algorithms, MONARC will give you the options of saving 10, 15 or 20% of your net balance after expenses and bills.

BALANCE CALCULATION SCREENS

SOCIAL MEDIA ‘LIKES’ = GOAL-ORIENTED SAVINGS

You choose how much you want to save-per-like. Let's say you want to save $0.10 per like. Garner 100 likes and you have saved $10. You go about your daily routine, posting as you wish, getting notifications when you have saved into MONARC. No change in inherent behavior but you do save with goals in mind.

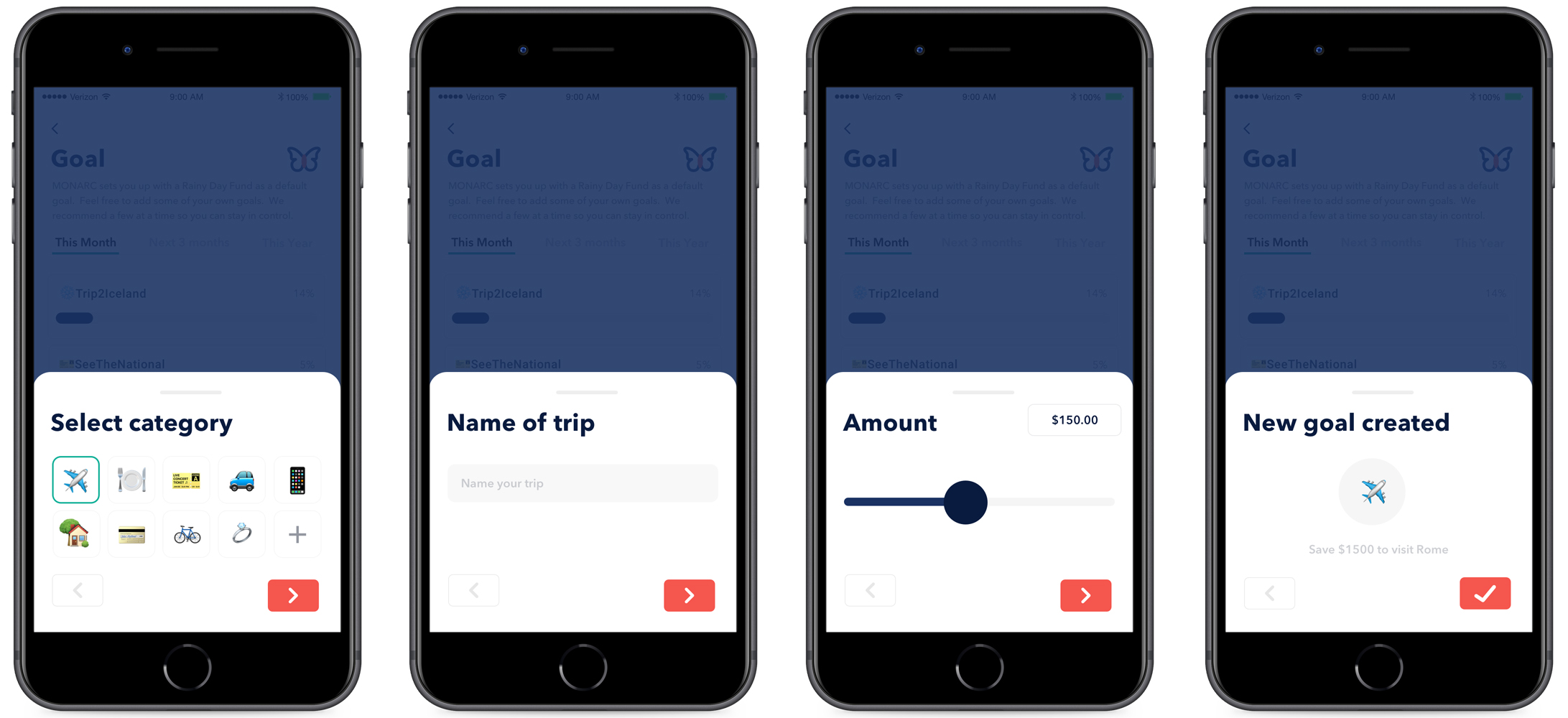

SET UP SPECIFIC GOALS

Practice a less impulsive spending habit by setting up a few short or long term goals that you wish to fulfill through your daily routine of posting on social media.

Before you know it, you will have started saving for a pair of sneakers, a fun trip somewhere, a concert or eventually, towards bigger goals like buying a home.

RETURN ENGAGEMENT

Millennials are social creatures (and social butterflies), at least digitally. They have a willingness and the tools to share their experiences like no other prior generation. Although discussing real dollar amounts is still considered taboo, they are willing to crowdsource financial advice.

In the MONARC Kaleidoscope network, you will never see actual dollar amounts of your fellow MONARCers, but you will be able to see the progress of their goals. Encourage each other with emojis and chats and be inspired as you save towards your goals.

KEY INSIGHTS

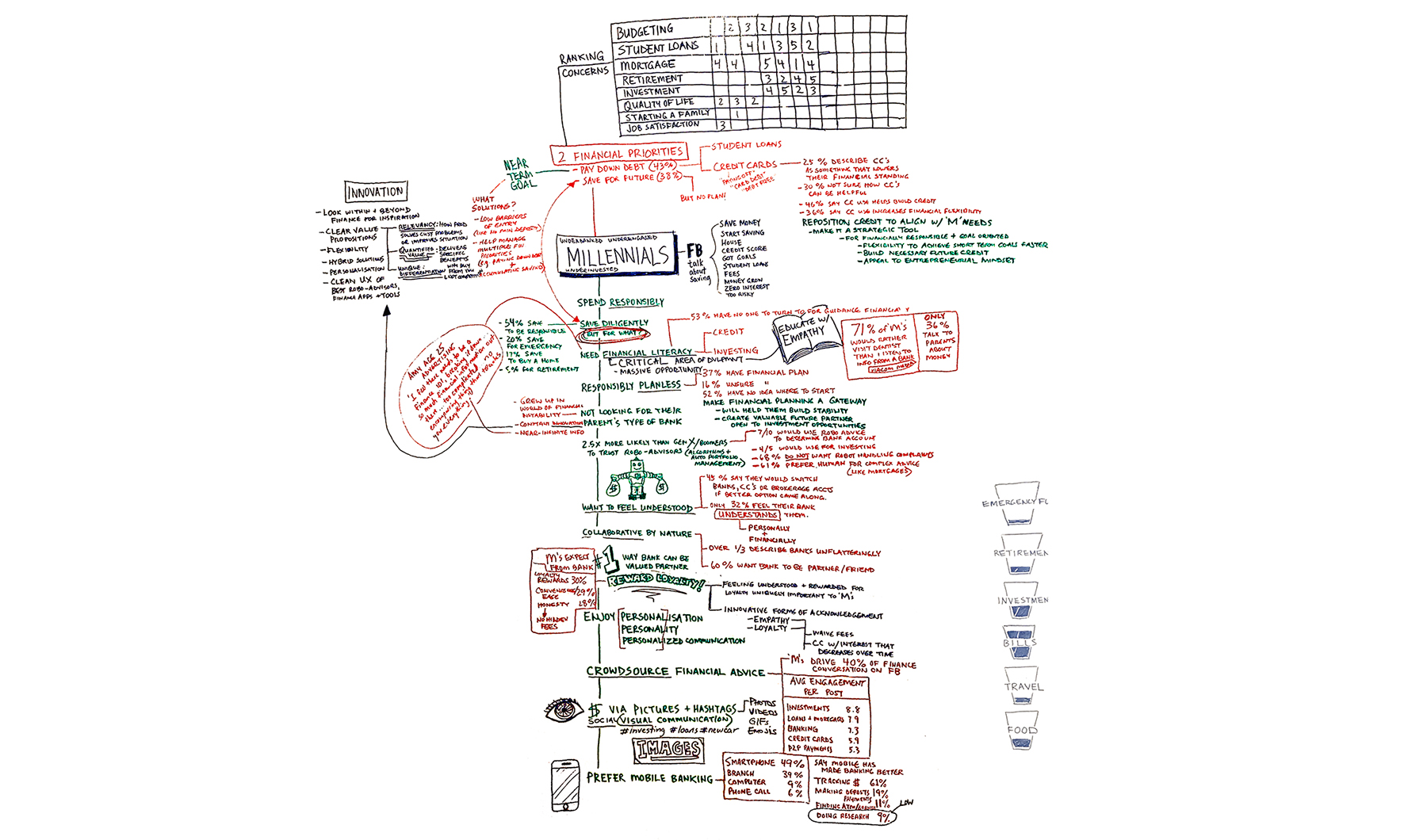

'Trust, relationships and technology' = new holy trinity for millennials

View tech as familiar, easy, friendly, clear and immediate

1/3 prefer Siri or Google for advice, rather than financial professionals

Consider trips to a traditional bank branch as inconvenient and unnecessary

Want to bank on their own terms

Experiences are much more important than things

More likely to spend money on experiences they can document on social media

Don't want obstacles to daily habits

Communicate primarily via photos, videos, hashtags and emojis

They utilize social media to communicate, share & get information

Simplicity leads to engagement

Great Recession resulted in tendency to spend responsibly but with no concrete plans or goals

Putting off marriage and other life milestones

Collaborative in nature

Willing to crowdsource financial advice

Don't overdo the features

The more clear and less complicated the idea, the more scale.

PROTOTYPE VIDEO

EARLY ITERATION

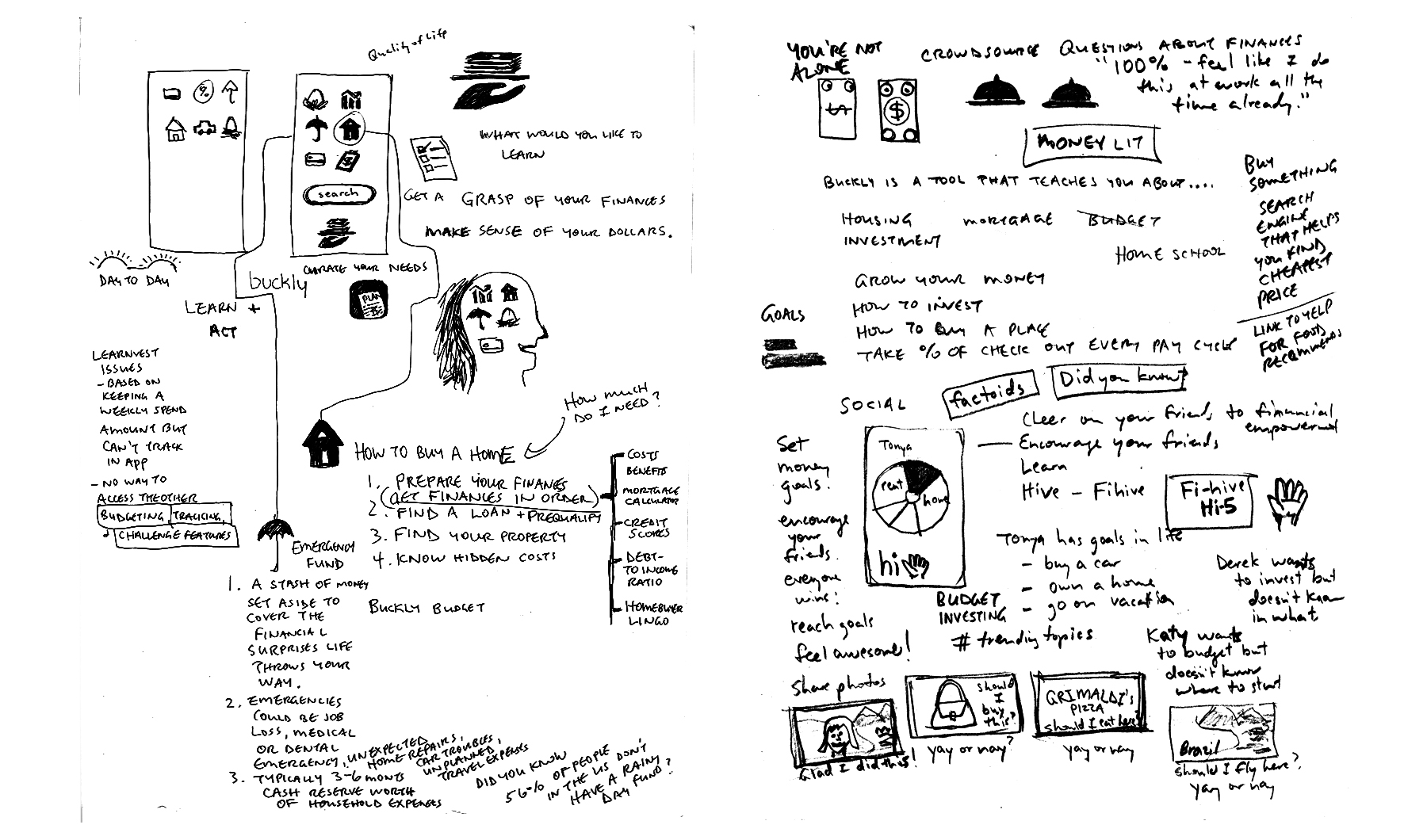

IDEATION + WIREFRAMING

RESEARCH

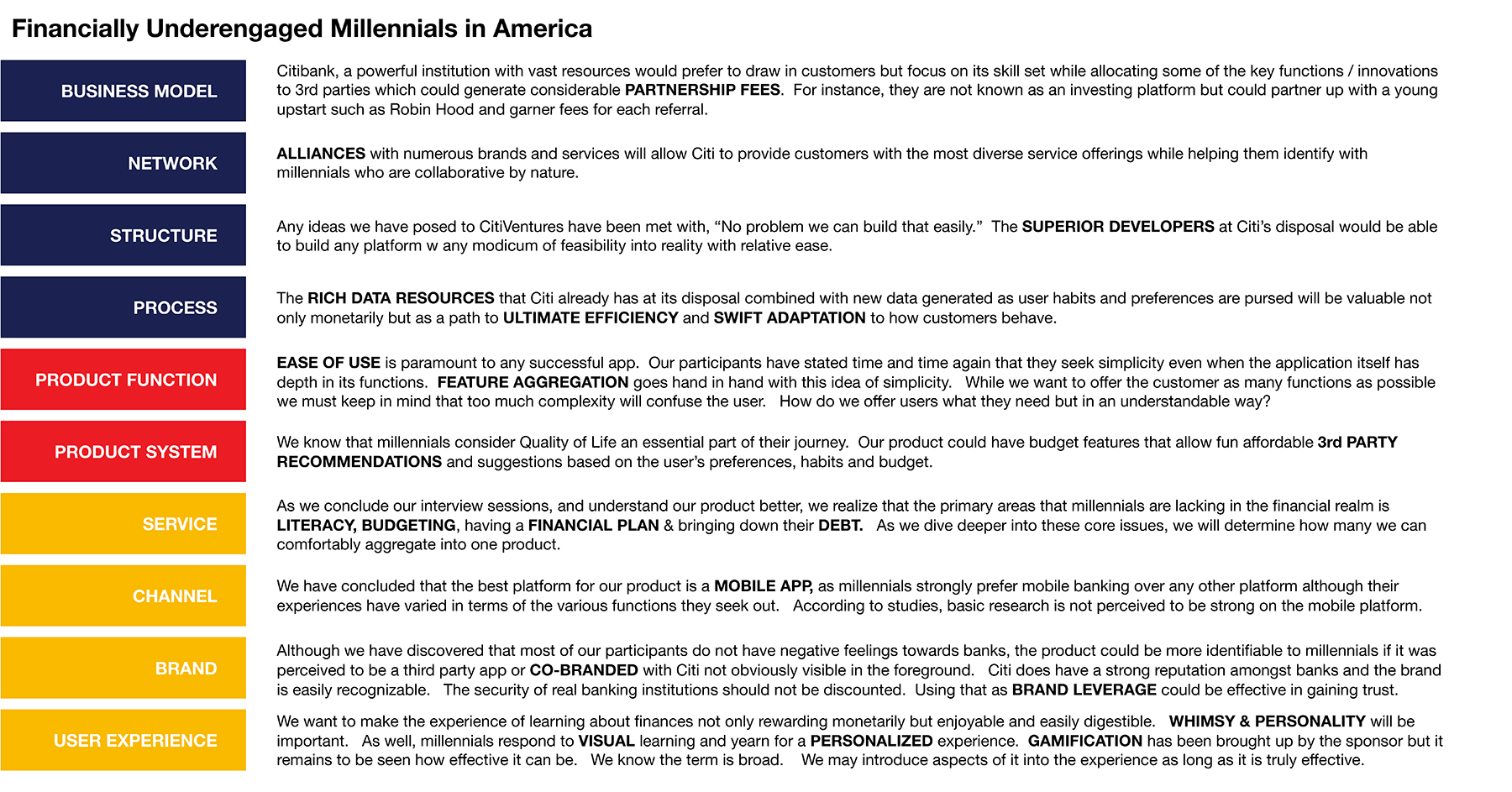

CONTEXT

By 2025, millennials will make 46 percent of all income in the U.S. Because of their sheer magnitude and subsequent buying + savings power, there’s a big financial benefit for banks in wooing this demographic and paying attention to their behaviors. We researched, surveyed and interviewed numerous millennials and gained valuable insights.

86 percent of the millennial generation are dependent on their smartphones according to a 2017 goEBT report. Their generation relies on phone apps and mobile tools to pay bills, view statements and set up recurring payments. They want the convenience of real-time updates on their finances instead of waiting for a monthly bank statement in the mail.

A 2017 sproutsocial blog post reported that Instagram usage is particularly strong among millennials. 48 million millennials rely on Instagram, skyrocketing to 2/3 by next year. Instagram currently has over 700 million total monthly active users. To put this into perspective, that’s over double the monthly active users of Twitter and 3Xs as much for monthly active users on WhatsApp and Facebook Messenger.

According to a 2017 GoBankingRates survey, respondents aged 25 to 34 who have:

$0 saved: 41 percent

Less than $1,000 saved: 20 percent

$1,000 to $4,999 saved: 13 percent

$5,000 to $9,999 saved: 6 percent

$10,000 or more saved: 20 percent

The numbers above have increased since the prior year 2016 suggesting that young Americans are beginning to realize the importance of having money saved, specifically in a savings account.

According to a 2016 CNBC report, "millennials are prioritizing their cars and homes less and less, and assigning greater importance to personal experiences — and showing off pictures of them."

We eventually came to the realization that the term under-banked was misleading. The majority of folks we spoke with were more under-engaged than simply under-banked.

PERSONAS

INTERVIEW EXCERPTS

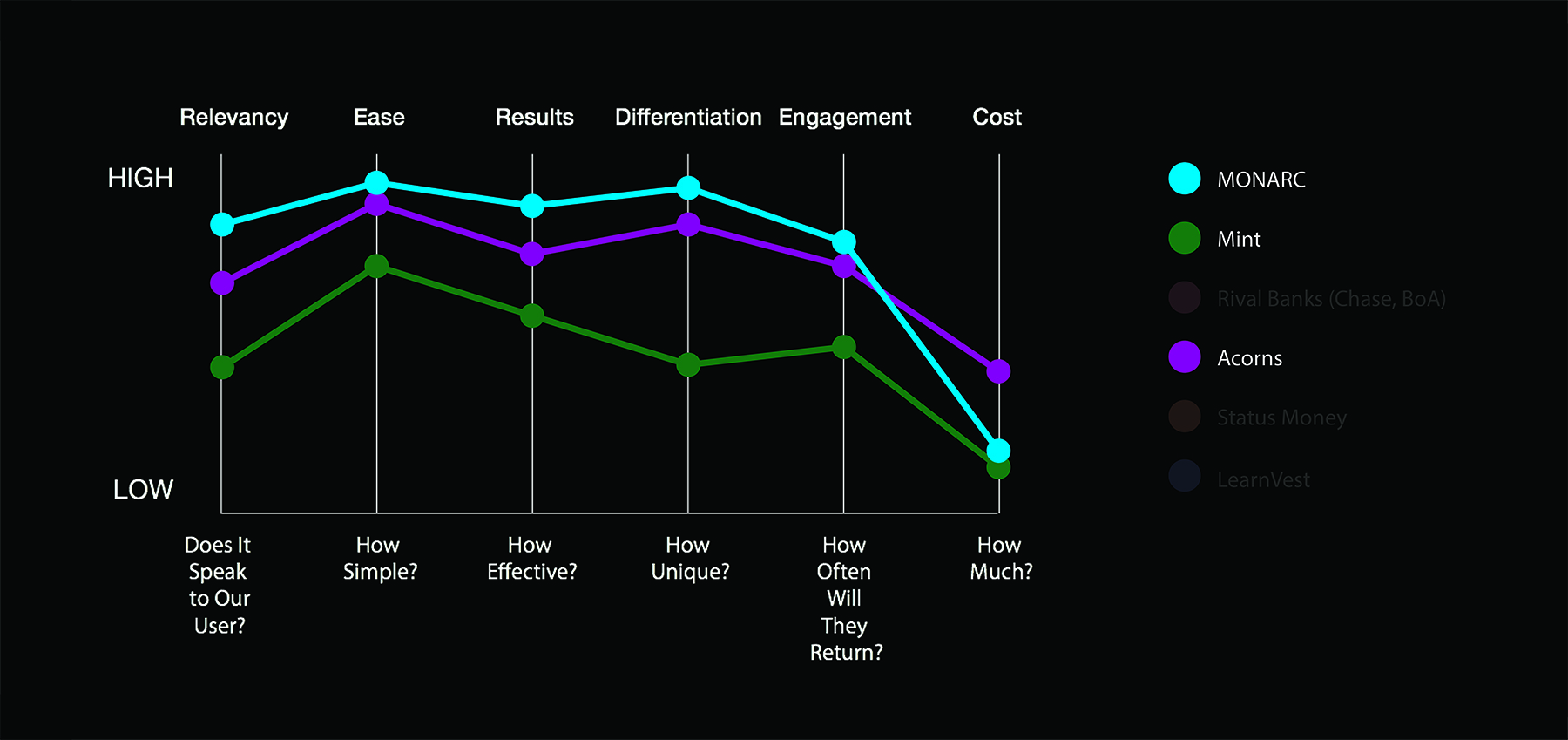

COMPETITOR ANALYSIS

“Millennials need to lead their lives with confidence. They need the financial foundations of their lives to be transparent and easy, on autopilot. But since it’s not; because it’s hard and scary and complex and confusing, they think they are just dumb. They don’t speak the language. Hint: fix the process. Simplify the decision. Make the finance an inherent and ideally invisible part of the process.”

-Roger Mader (Ampersand)